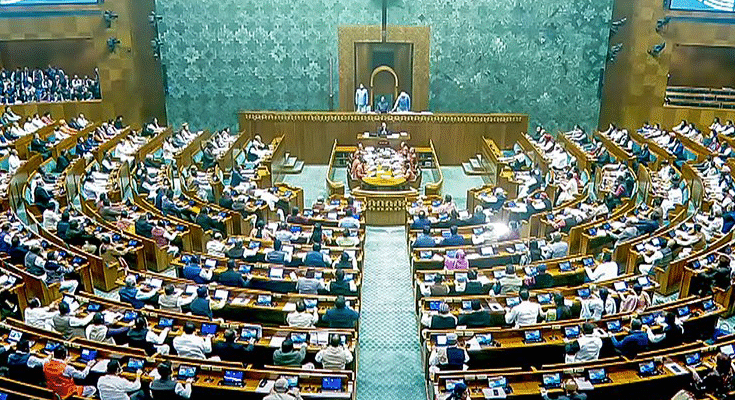

New Delhi: The Lok Sabha on Monday cleared the Modified Income Tax Bill, 2025, and the Taxation Laws (Amendment) Bill, 2025, in a swift voice vote — without any debate — amid Opposition protests over Bihar’s electoral roll revision. The bills, tabled moments earlier by Finance Minister Nirmala Sitharaman, will now move to the Rajya Sabha before seeking presidential assent.

The new bill, replacing the withdrawn February version, incorporates nearly all 285 recommendations of the Select Committee headed by BJP MP Baijayant Panda, alongside stakeholder inputs for legal clarity. It aims to replace the 1961 Income Tax Act while simplifying language, removing obsolete clauses, and making tax provisions more readable for common citizens.

Key Changes in the Modified Bill:

- Effective from April 1, 2026, tax will be paid in the same year income is earned, replacing the “previous year” concept.

- Refunds allowed even for late ITR filings; penalties waived for accidental non-compliance.

- No penalty on delayed TDS filing; option for ‘nil certificate’ for those with no tax liability, including NRIs.

- Replaces ‘Financial Year’ and ‘Accounting Year’ with ‘Tax Year’.

- Restores Section 80M deduction for intercorporate dividends to avoid dual taxation.

- Maintains current tax slabs, capital gains rules, and income categories.

- Defines ‘capital asset’, ‘micro and small enterprises’, and ‘beneficial owner’ with more clarity.

- 30% standard deduction for rental income; interest on property loans deductible.

The accompanying Taxation Laws (Amendment) Bill, 2025 provides:

- Tax exemptions for subscribers of the Unified Pension Scheme (UPS), aligning benefits with the NPS.

- Tax benefits for investments by Saudi Arabia’s public investment funds.

The government withdrew the earlier draft last week to eliminate confusion from multiple versions. Sitharaman said most committee suggestions were adopted to simplify the tax code and align drafting with judicial interpretations.

Both bills were passed without discussion before the House was adjourned for the day.