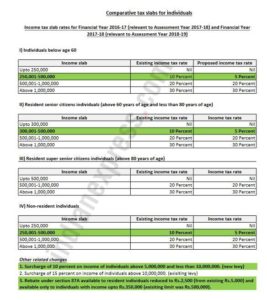

In a major step, Finance Minister Arun Jaitley announced the reduction of the existing rate of taxation for individuals with income ranging between Rs 2.5 lakh to Rs 5 lakh to 5% instead of 10%. There will be a surcharge of 10% for those whose annual income is Rs 50 lakh to Rs 1 crore. Additionally, the 15% surcharge on Rs 1 crore or more remains unchanged. This is to make up for Rs 15,000 crore loss due to the cut in the personal income tax rate.

In a major step, Finance Minister Arun Jaitley announced the reduction of the existing rate of taxation for individuals with income ranging between Rs 2.5 lakh to Rs 5 lakh to 5% instead of 10%. There will be a surcharge of 10% for those whose annual income is Rs 50 lakh to Rs 1 crore. Additionally, the 15% surcharge on Rs 1 crore or more remains unchanged. This is to make up for Rs 15,000 crore loss due to the cut in the personal income tax rate.

“This would reduce the tax liability of all persons below Rs 5 lakh income either to zero (with rebate) or 50% of their existing liability. In order not to have duplication of benefit, the existing benefit of rebate available to the same group of beneficiaries is being reduced to Rs 2500 available only to assessees upto income of Rs 3.5 lakhs. The combined effect of both these measures will mean that there would be zero tax liability for people getting income up to Rs 3 lakhs p.a. and the tax liability will only be Rs 2,500 for people with income between Rs 3 and Rs 3.5 lakhs,” the finance minister said in his budget.

“If the limit of Rs 1.5 lakh under Section 80C for investment is used fully, the tax would be zero for people with income of Rs 4.5 lakhs. While the taxation liability of people with income up to Rs 5 lakhs is being reduced to half, all the other categories of tax payers in the subsequent slabs will also get a uniform benefit of Rs 12,500 per person. The total amount of tax foregone on account of this measure is Rs 15,500 crores,” he said.

Jaitley said only 1.74 crore individuals filed income tax returns as against 4.2 crore people working in the organised sector. The advance tax on personal Income tax was increased by 34.8 percent due to demonetisation, the finance minister added.

Making a case for widening the tax net, Jaitley said the lower entry-level tax rate will expand the base in the coming year. He made a case for the same by explaining how the Direct Tax collection in India is not commensurate with spending. While 3.7 crore individuals filed returns, 99 lakh showed income below the exempt limit, 1.95 crore were between Rs 2.5 and Rs 5 lakh and only 24 lakh were above Rs 10 lakh. Out of 76 lakh individual assessee who declare over Rs 5 lakh income, a major chunk of 56 lakh are salaried. “India is a largely tax non-compliant society thanks to the presence of large cash economy which allows tax evasion,” the FM said.